Certified Public Accountant (CPA)

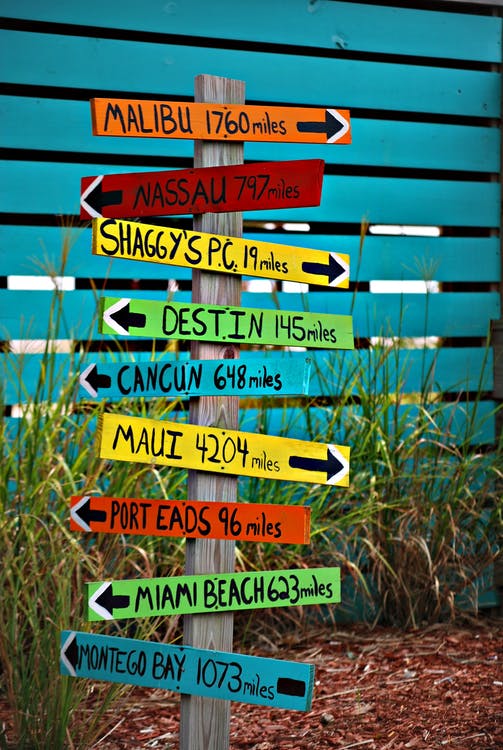

You’ll go places as a CPA. Where, you may ask? From international companies to small businesses, from running your own shop to managing a firm, the sky is the limit.

Oh the places you will go

CPAs are prominent business decision makers in a wide range of industries. Those industries can span sports, entertainment, manufacturing, service, and non-profit organizations. They also hold leadership positions in education, government, law enforcement, and public accounting.

Public Practice

Work for yourself, a large multinational firm, or anything in between. Public practitioners advise individuals and businesses as objective outsiders.

CPAs in public practice work with clients on-site. CPAs often specialize in one or more areas of practice, such as the specialty areas listed below.

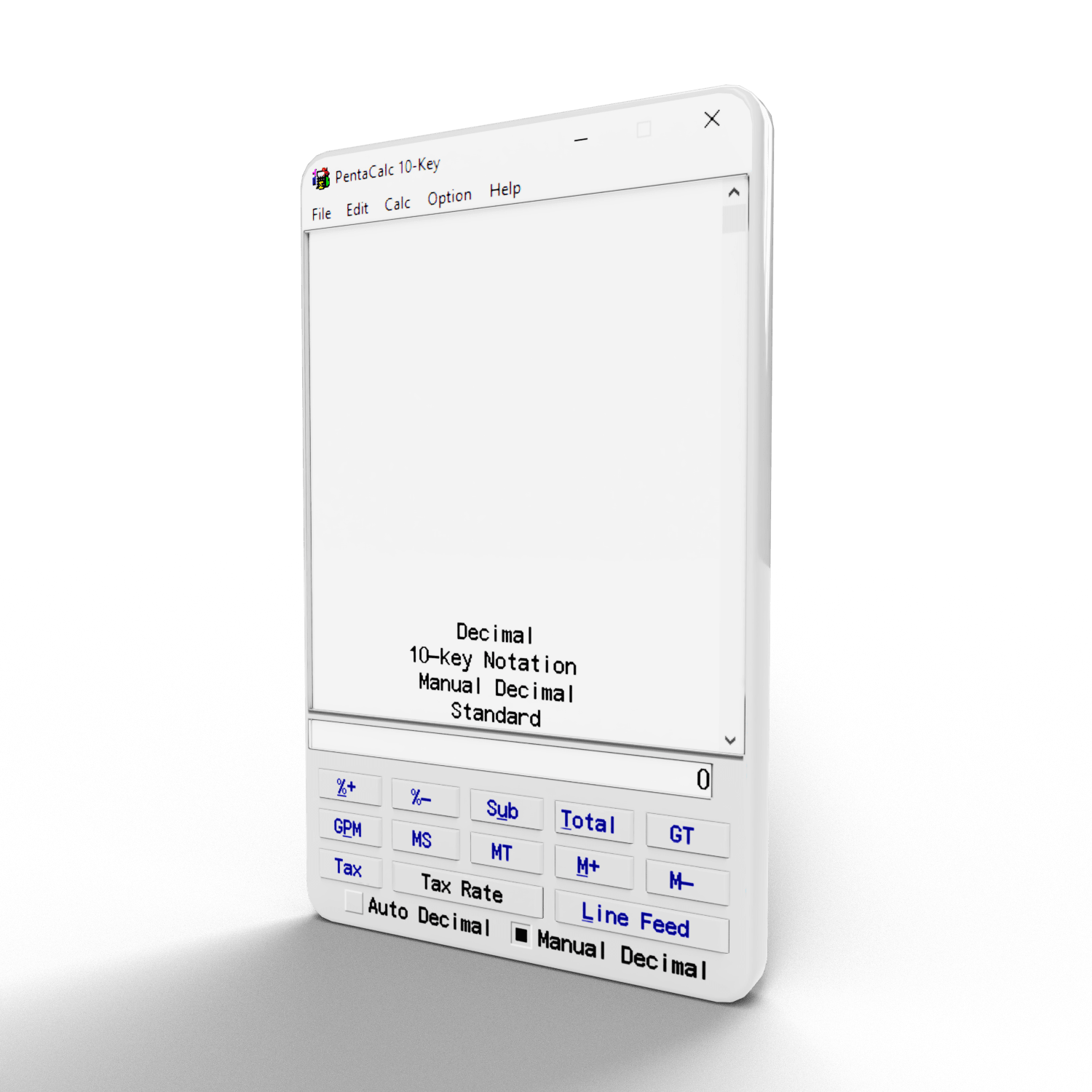

GET THE MOST RECOMMENDED 10 KEY SOFTWARE AVAILABLE

10 KEY CALCULATORS HELP INCREASE YOUR EFFICIENCY AND SAVE TIME. THE 10 KEY CALCULATOR SOFTWARE IS EASY TO USE AND USER-FRIENDLY 10 KEY SOFTWARE.

Audits

CPAs examine clients’ financial statements, provide advice on internal control systems and assist with reports for the Securities and Exchange Commission (SEC) and other regulatory agencies.

- Tax – Help clients comply with tax laws, provide consultations for tax planning, and represent clients before the Internal Revenue Service.

- Management – Provide advice on information technology services, production and marketing techniques, and improving operating procedures.

Industry

If a company makes money and spends money, it’s likely there’s a CPA on board.

CPAs employed in industry are responsible for developing, producing, and analyzing data useful for making business decisions. The data can also be used for reporting to internal and external interested parties. Industry CPAs report on past operations, interpret results for management and forecast future financial results and capital requirements.

CPAs may go by the title of controller or chief financial officer.

Education

CPAs hold faculty positions in the the collegiate world, working for community colleges and four-year universities.

Government

Work for government agencies at local, state, and national levels.

Governmental organizations need accurate data to evaluate the financial results of their activities and plan for the future.

Government agencies that use CPA include the U.S. Navy, the FBI, and the NASA. The Department of the Treasury and the Department of Defense scores of CPAs.

Other Specialty Areas

Consulting – Give objective advice and assistance to individuals, businesses, financial institutions, non-profit organizations, and government agencies.

Information Technology (IT) – Implements advanced systems to fit an organization’s needs.

Forensic Accounting – Search for evidence of criminal misconduct.

Environmental Accounting – Conduct compliance audits and design preventive systems.

International Accounting – Master international trade laws and regulations for the global economy.

Tax and Financial Planning – Help clients save for goals like retirement, save for their children’s college educations, and prepare for mergers and acquisitions.